Gold is at all-time highs, analysts are forecasting continued strength, and junior gold stocks are significantly outperforming senior producers. Forge Resources’ Alotta Project offers exposure to a district-scale system in Yukon’s Dawson Range.

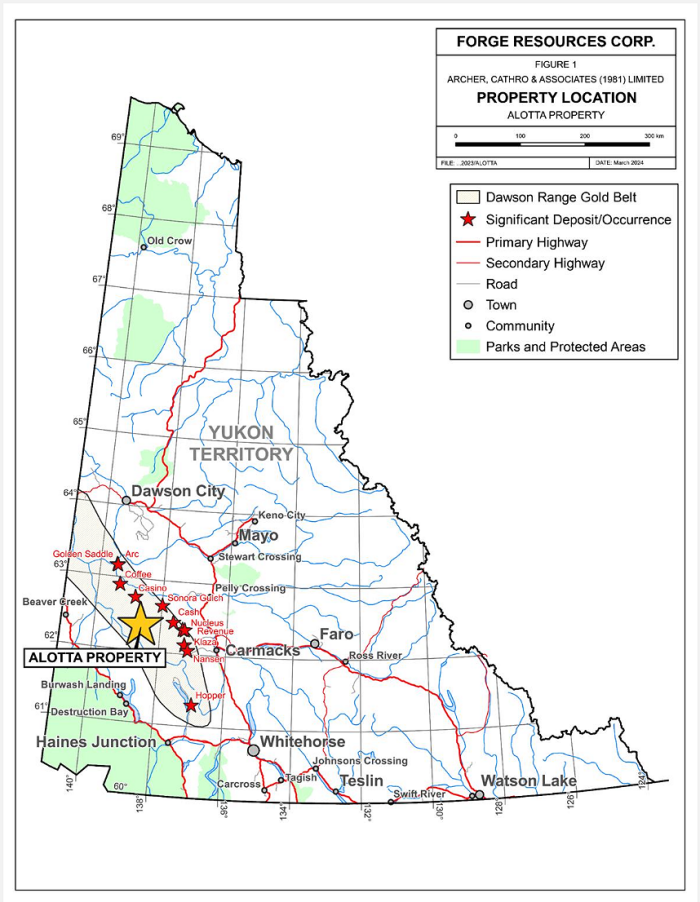

Forge Resources’ Alotta Project is strategically located in Yukon’s Dawson Range, ~40 km from the Casino deposit, within a proven district-scale gold-copper system

Quick Hits that Will be Discussed:

- CSE: FRG neighbors Western Copper and Gold’s Casino project, considered one of the largest undeveloped gold-copper deposits in the world

- Located in the Dawson Range gold belt in Yukon, Canada, CSE: FRG counts multiple multi-billion-dollar majors in their area

- CSE: FRG represents a potentially undervalued opportunity as a junior gold exploration company

- FRG’s initial drill hole completed in the Alimony Zone (hole ALT-25-013) returned encouraging gold values signaling a new exploration target with scale potential beyond the initially drilled areas.

- Noted Canadian mining magnate, investor and co-founder of Franco-Nevada Mining Corporation, Pierre Lassonde, recently stated “The stars for the Yukon are aligned and the time is now.”

- Gold prices have hit all-time highs and experts and analysts continue to share bullish outlooks for the yellow metal, many noting an impending “super-cycle”

- Recent analyst report from Atrium Research places a 1.20 price target on CSE: FRG, suggesting a significant upside from current levels

The table is set for this under-the-radar junior exploration gem positioned in a Tier-1 mining jurisdiction and neighboring one of the largest undeveloped gold-copper deposits in the world.

Prime Yukon Location

Located in the Dawson Range gold belt in Yukon, Canada, the Alotta Project sits approximately 40 km from Western Copper and Gold’s Casino deposit, one of the largest undeveloped gold-copper deposits globally

Impressive Gold Intercepts

Recent drilling returned strong gold values, including 76.93m @ 2.03 g/t Au and a bonanza-grade interval of 3.15m @ 45.01 g/t Au. Visible gold was encountered in a 1.25m interval grading 105 g/t Au, highlighting high-grade potential within broader mineralized zones.

Large-Scale Exploration Potential

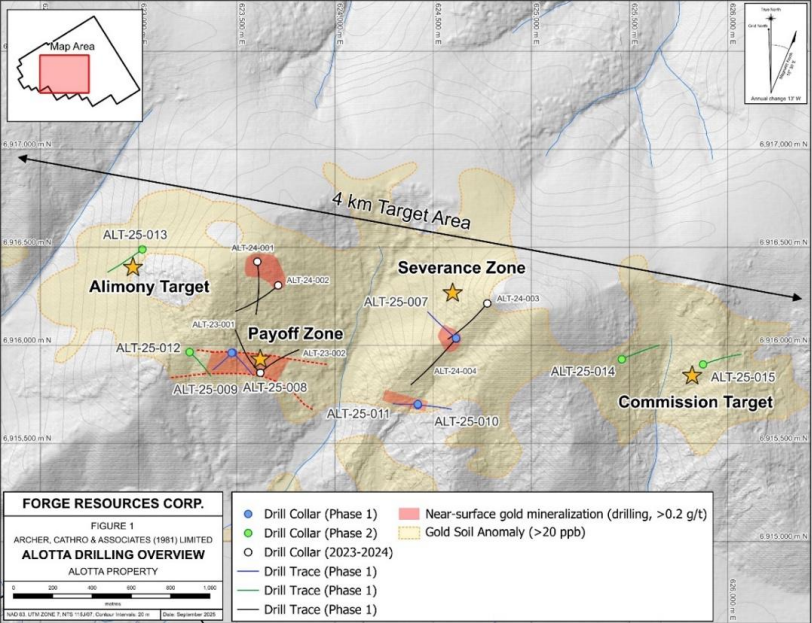

The Alotta Project demonstrates widespread gold mineralization across multiple zones including Payoff, Alimony, Severance, and Commission.

Junior Gold Stocks Are Outperforming

Junior gold stocks are significantly outperforming senior producers, with the VanEck Junior Gold Miners ETF (GDXJ)

"We are extremely pleased that every drill hole completed to date has intersected mineralization, with severalshowing significant widths."

- PJ Murphy, CEO of Forge Resources

District-Scale Potential in a Proven Gold Belt

Alotta is positioned in a proven mineral district with world-class potential in Yukon’s Dawson Range gold belt. Its geological setting supports models linked to large porphyry systems and enhances valuation comparables within the region.

Key Points:

- Located ~40 km southeast of Western Copper and Gold’s Casino deposit

- Situated in one of the largest undeveloped gold-copper districts

- Strengthens geological probability through analogous deposit models

- Supports investor perception within a major-producing corridor

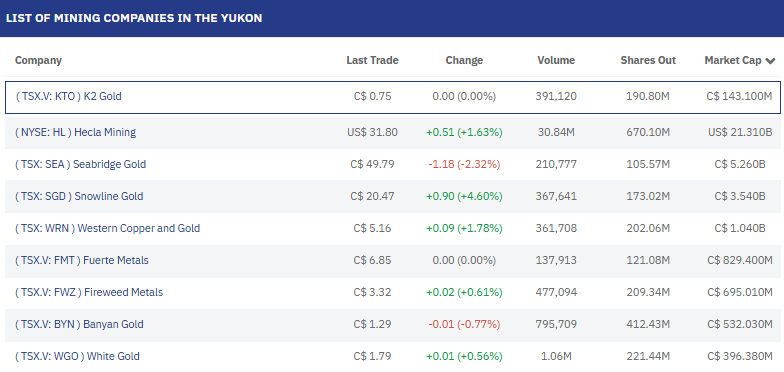

Major Companies in the Area:

- Snowline Gold Corp. (Market Cap 3.017B)

- Seabridge Gold Inc. (Market Cap 4.548B)

- Fireweed Metals Corp. (Market Cap 664.258M)

- Banyan Gold Corp. (Market Cap 424.803M)

- White Gold Corp. (Market Cap 279.009M)

Forge Resources (CSE: FRG) is located among multi-billion-dollar peers while currently valued at a fraction of their market capitalizations.

Forge Resources (CSE: FRG), may be an undervalued opportunity.

While FRG is located just 40km southeast of Western Copper and Gold’s (TSX: WRN) Casino deposit and surrounded by multiple multi-billion-dollar companies they are currently valued at a fraction of the market cap.

Initial Drill Results Could Change Current Value:

CSE: FRG recently announced full gold assay results from drill hole ALT-25-012 at their Alotta property Payoff Zone.

Key highlights, based on the company’s December 16, 2025 full-assay release include:

- Broad mineralized interval: 76.93 m @ 2.03 g/t Au from 223.00 m to 301.00 m.

- Higher-grade core within the broad zone: 44.75 m @ 3.40 g/t Au from 256.23 m to 301.00 m.

- Very high-grade interval within the zone: 8.16 m @ 17.71 g/t Au from 284.93 m to 293.10 m.

- Bonanza-grade shoot (composited): 3.15 m @ 45.01 g/t Au from 286.00 m to 289.15 m (within the 8.16 m interval).

- Visible-gold interval: 1.25 m @ 105 g/t Au from 287.15 m to 288.40 m, associated with a low-angle, ~10 cm quartz vein carrying visible gold and bismuthinite plus sulphides.

- Adjacent gold-bearing vein interval: 1.15 m @ 8.85 g/t Au from 286.00 m to 287.15 m, immediately preceding the 105 g/t interval.

And, CSE: FRG has reported results from drill hole ALT-25-013, the first and only hole drilled at the Alimony Zone.

- Widespread near-surface gold mineralization was discovered, including 112.21 m grading 0.66 g/t Au near surface from 35.29 metres, including 55.52 m grading 1.04 g/t Au and including 1.6 m grading 25.8 g/t Au. All intervals are drilled core lengths.

- The Alimony Zone lies approximately 800 m west of the Payoff Zone (575 m northwest of drill hole ALT-25-012, above). No drilling has been completed between these two zones.

- This drill hole represents a new drilling discovery at the Alotta Project.

A total of 2685.66 m of drilling in 9 drill holes were completed by the Company in 2025.

Surface expression of mineralization includes overlapping of gold, copper and molybdenum soil geochemical anomalies that is over 4 km in length and nearly 2 km wide.

The Company was able to successfully test most surface showings, with 2025 holes drilled into the Severance, Payoff, Alimony and Commission zones. These zones are very wide-spread but consistently returned altered and mineralized bedrock confirming a very large system underlies the Alotta property.

CSE: FRG’s Alotta Project has been called District -Scale, meaning:

- A large, continuous mineralized system

- Multiple zones, centers, or targets within one geologic system

- Potential for multiple deposits or a very large deposit

Why this Matters:

- Long mine life potential

- Multiple development paths

- Attractiveness to majors (they look for scale)

- Justification for aggressive drilling

Pierre Lassonde has called Yukon, Canada a prime location for investment due to high-grade discoveries.

And Lassonde’s name carries significant weight.

Pierre Lassonde is a prominent Canadian mining entrepreneur and financier, best known as the co-founder and former president of Franco-Nevada, one of the world’s leading gold-focused royalty and streaming companies. He is widely regarded as one of the most influential figures in modern precious-metals investing and the royalty business model.

Those high-grade discoveries mentioned by Lassonde could deliver considerable returns as he has noted 2026 will bring on a “super-cycle” for gold driven by global fiscal instability and shifting reserve assets.

An image may be worth a thousand words but gold may be worth even more:

- Target of $17,250: Lassonde argues that a peak of $17,250 per ounce is possible in this super-cycle (peaking around 2032), based on the "math" of capital flows moving just 1% of other asset classes into the finite gold market.

- Near-Term Targets: For the next three years, he sees gold rising toward $6,000.

Current Gold Prices and Trends Support Bullish Outlook

The yellow metal continues to top new all-time high, recently crossing the $4,600 per oz. level and there are now signs of that slowing- in fact, current projections stand a good chance at revision considering the aggressive climb we’ve already seen:

- JPMorgan: Expects gold to average $5,055/oz, pushing towards $5,000 by Q4 2026.

- Goldman Sachs: Aims for $4,900/oz, highlighting strong upside if ETF demand increases.

- Morgan Stanley: Forecasts $4,800/oz by late 2026, citing lower rates and central bank buying

- Bank of America: Raised its 2026 forecast to $5,000/oz, noting strong investment demand and tightening supply.

This all leads to where Forge Resources is heading and with the metals market exploding and recent operational developments tied to their drilling it should come as no surprise to see analysts offering an optimistic outlook.

Following their Dec. 16, 2025 press release announcing drill results Atrium Research issued an analyst report noting:

“As of today’s release, we have upped our overall valuation for Alotta to $35.7M or $0.34/share, from $17.8M previously (this also considers the 60% ownership in the project). This large increase is based on the highly impressive drill results to-date at Alotta with significant gold intersections hit in two different zones as part of this program. Notably, the two gold zones are ~800m apart, providing potential for material size and scale to the Alotta project.”

Within that analyst report Atrium issued a 1.20 price target- marking a significant upside from CSE: FRG’s current standing.

Project Highlights & Key Metrics

$35.7M

Project Valuation

4,723 ha

Large-scale project footprint

4 km

Mineralized Trend

Recent Press Release

Forge Encounters Coal Seam amid Rising Coal Prices and Completes Resin Injections at La Estrella, Colombia

January 20, 2026 8:30 AM EST

Forge Resources Delivers Excellent 2025 Results and Advances Major Discoveries at the Alotta Project, Yukon

January 15, 2026 8:30 AM EST

Forge Resources Intersects 3.4 g/t Gold over 44.75 Metres, and 800 Metre Step-Out Discovers 1.04 g/t Gold over 55.52 Metres at Alotta, Yukon

December 16, 2025 8:30 AM EST

Unlock Key Insights into Forge Resources’ Vision & Strategy

Discover how Forge Resources is advancing the Alotta Project in Yukon’s prolific Dawson Range — a district-scale gold system located near one of the world’s largest undeveloped gold-copper deposits.

Download the corporate presentation to explore:

- Prime Location: Strategically positioned ~40 km from the Casino deposit in a proven gold-copper district.

- High-Grade Drill Results: Strong recent intercepts highlight significant gold potential across multiple zones.

- District-Scale Opportunity: Widespread mineralization and large-scale exploration upside in a Tier-1 mining jurisdiction.